Budget payment plans allow your customers to spread out their oil delivery payments over a set number of months. Read below to understand exactly how to set up a budget plan for an account.

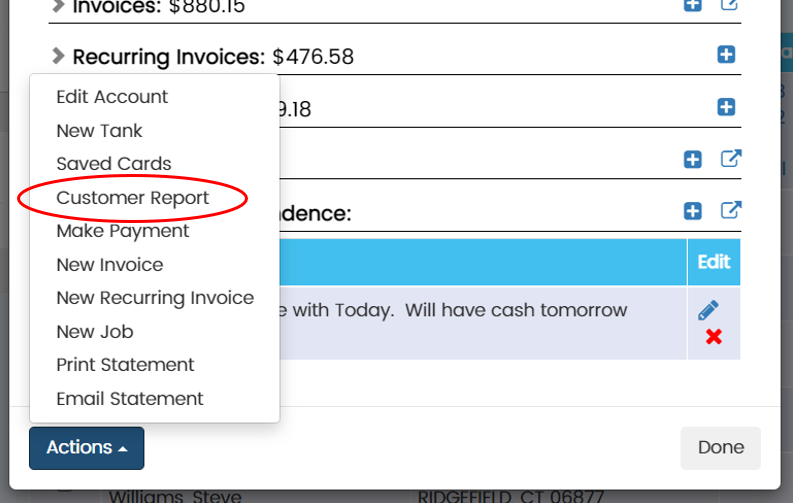

Before you begin, you must first estimate the total budget amount for the customer. Go to Account>Actions>Customer Report to see how much oil the customer uses over a given period of time. Multiply expected gallons by the anticipated full price to determine total budget amount. For example, 1,000 gallons x $4.00 / gallon = $4,000.

Once you know how much to budget, you’ll want to create a Recurring Invoice. A recurring invoice is a tool for creating the budget payment plan.

The way to think of a budget plan is as follows: You (the dealer) are lending the customer a certain amount of money (providing a loan) for fuel for a season. The customer will pay this amount back over the course of the budget period. This loan will present itself as a credit balance on the customer’s account. This credit balance can be used toward fuel throughout the season until the full amount of the loan (credit balance) is depleted. Monthly invoices for the budget payment amounts due will automatically be generated by the system each month. The amount due (from the customer) at any given time will be displayed in the top left of the Account screen.

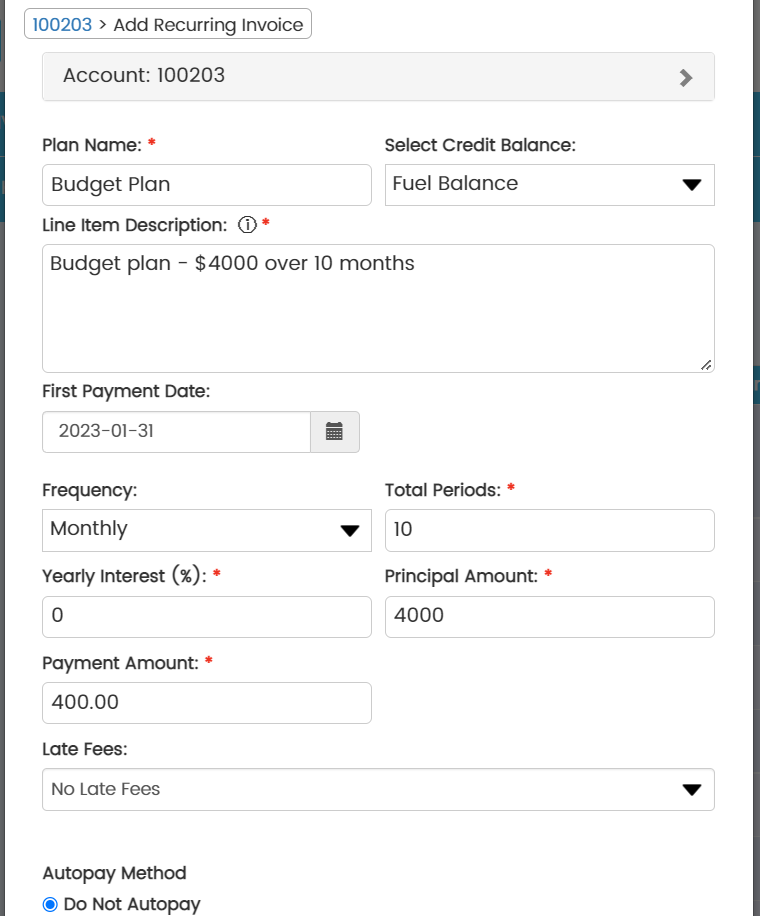

Plan Name: Name this Budget or something similar such as Budget Oct-Jun $400.

Select Credit Balance: Use Fuel Balance for this so the budget amount can be used toward fuel purchases, and not items such as service work.

Line Item Description: Provide a little more detail here.

First Payment Date: This is when the first payment will be due. If autopay is selected (for customers with credit cards on file), the card will be charge starting on this date.

Frequency: Monthly is most common.

Number of Periods: Set the number of payments in the plan. Usually 8-12 is most common.

Yearly Interest: This is OPTIONAL. If you would like to incorporate interest charges in the budget plan, you can do so here.

Principal Amount: This is the TOTAL amount for the plan.

Payment Amount: This amount will be calculated based on the Principal Amount and the Number of Periods.

Late Fees: Also OPTIONAL and will be automatically charged on late invoices.

Autopay: If a customer has a credit card on file, you can select it here.

Once you finish adding the Recurring Invoice, a new amount will automatically show up as a CREDIT BALANCE on the customer’s account. You can then use the credit balance to pay for deliveries on the customer’s account in the future.