Budget payment plans are great allowing customers to spread out their payments over a number of months. Follow these steps for setting up a budget payment plan if you have not done so already.

Once a budget plan has been set up, a customer will have a credit balance for the full amount of the budget. This credit balance should be used to pay for any deliveries made during the budget season.

When a budget plan is configured, the total number of periods (usually months) will be set. At the end of each period, an invoice will automatically be generated for that period. When this happens, the amount due in the top left of a customer’s account screen will increase. You will also see a number appear next to Invoices, indicating that there is at least one open invoice at that point.

When a customer sends in a budget payment check, apply the payment to the open invoice for that amount. Do not apply the check to any open orders or to a credit balance.

When a delivery is made during the budget season, set the Budget Credit Balance as the payment method for the order. This will reduce the available funds left in the customer’s budget plan.

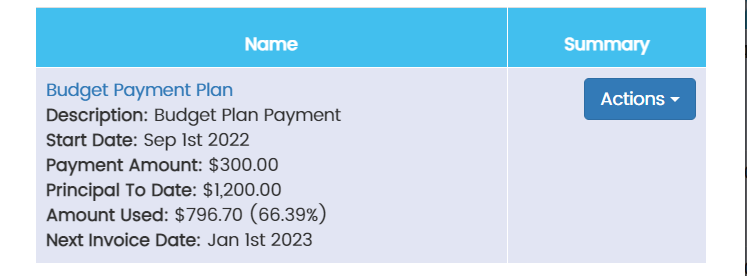

To see a summary of how far along a customer is in his or her budget plan, click on Recurring Invoices and a summary will be provided.

In this view, the Payment Amount is the monthly payment amount. The Principal To Date is the amount of the budget that has been invoiced to date. In this case, 4 months have passed for a total of $1,200 of budget payments that have been invoiced. Amount Used shows how much of the amount billed has already been used toward heating oil. In this case, the customer has used about 2/3 of the amount billed thus far. This number can exceed 100% if the customer receives a delivery early in the budget season, or does not have a large enough payment set up.

For another view of open budget plans, go to Reports>Accounting – Budget Plans. Set the date range for the whole year to include budgets that were set earlier in the year.